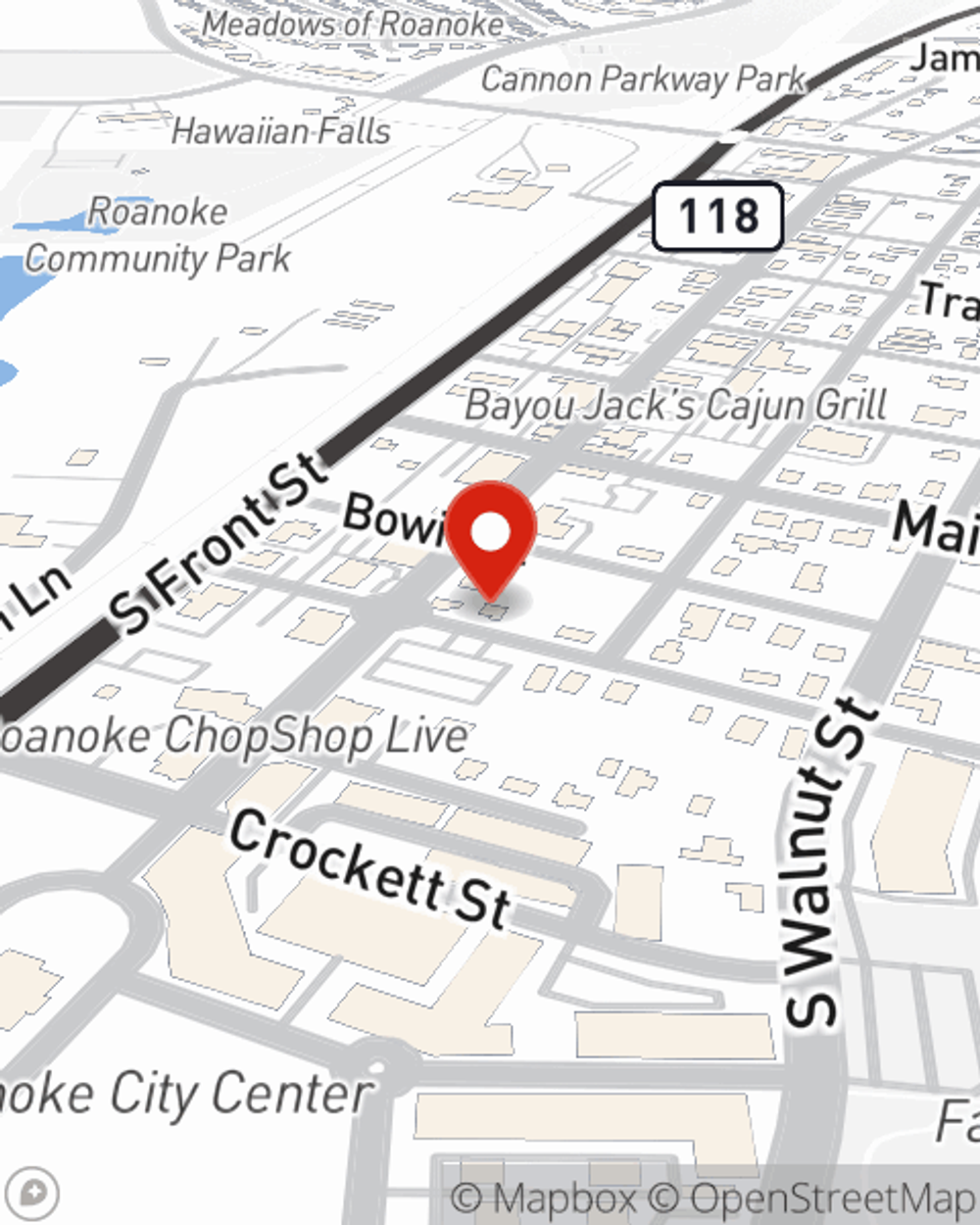

Life Insurance in and around Roanoke

Get insured for what matters to you

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

Your Life Insurance Search Is Over

It may make you uneasy to contemplate when you pass, but preparing for that day with life insurance is one of the most significant ways you can express love to your partner.

Get insured for what matters to you

Life won't wait. Neither should you.

State Farm Can Help You Rest Easy

The beneficiary designated in your Life insurance policy can help cover bills and other expenses for the people you're closest to when you pass. The death benefit can help with things such as ongoing expenses, college tuition or rent payments. With State Farm, you can rely on us to be there when it's needed most, while also providing caring, reliable service.

When you and your family are insured by State Farm, you might sleep well at night knowing that even if the worst comes to pass, your loved ones may be covered. Call or go online today and discover how State Farm agent Garrett Spegar can help you protect your future.

Have More Questions About Life Insurance?

Call Garrett at (817) 571-2500 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

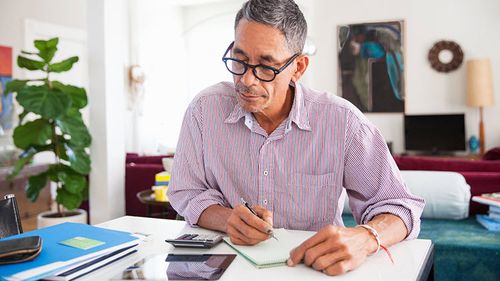

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

Garrett Spegar

State Farm® Insurance AgentSimple Insights®

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.