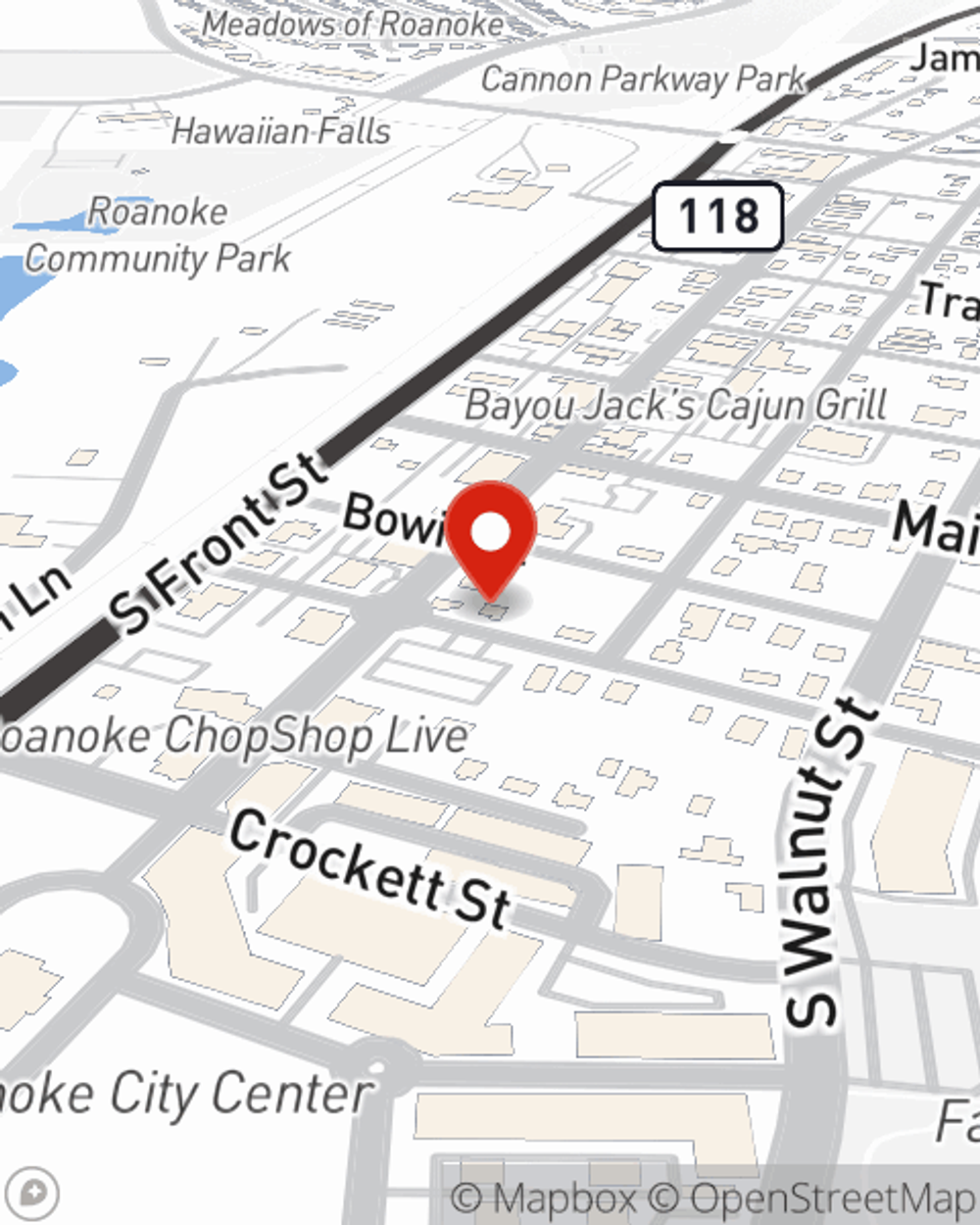

Business Insurance in and around Roanoke

Looking for insurance for your business? Look no further than State Farm agent Garrett Spegar!

Helping insure small businesses since 1935

State Farm Understands Small Businesses.

Small business owners like you wear a lot of hats. From customer service rep to HR supervisor, you do as much as possible each day to make your business a success. Are you a physician, a surveyor or a psychologist? Do you own a camera store, a toy store or a janitorial service? Whatever you do, State Farm may have small business insurance to cover it.

Looking for insurance for your business? Look no further than State Farm agent Garrett Spegar!

Helping insure small businesses since 1935

Strictly Business With State Farm

Your business thrives off your passion creativity, and having great coverage with State Farm. While you make decisions for the future of your business and lead your employees, let State Farm do their part in supporting you with business owners policies, artisan and service contractors policies and commercial liability umbrella policies.

As a small business owner as well, agent Garrett Spegar understands that there is a lot on your plate. Call or email Garrett Spegar today to get more information on your options.

Simple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Garrett Spegar

State Farm® Insurance AgentSimple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.